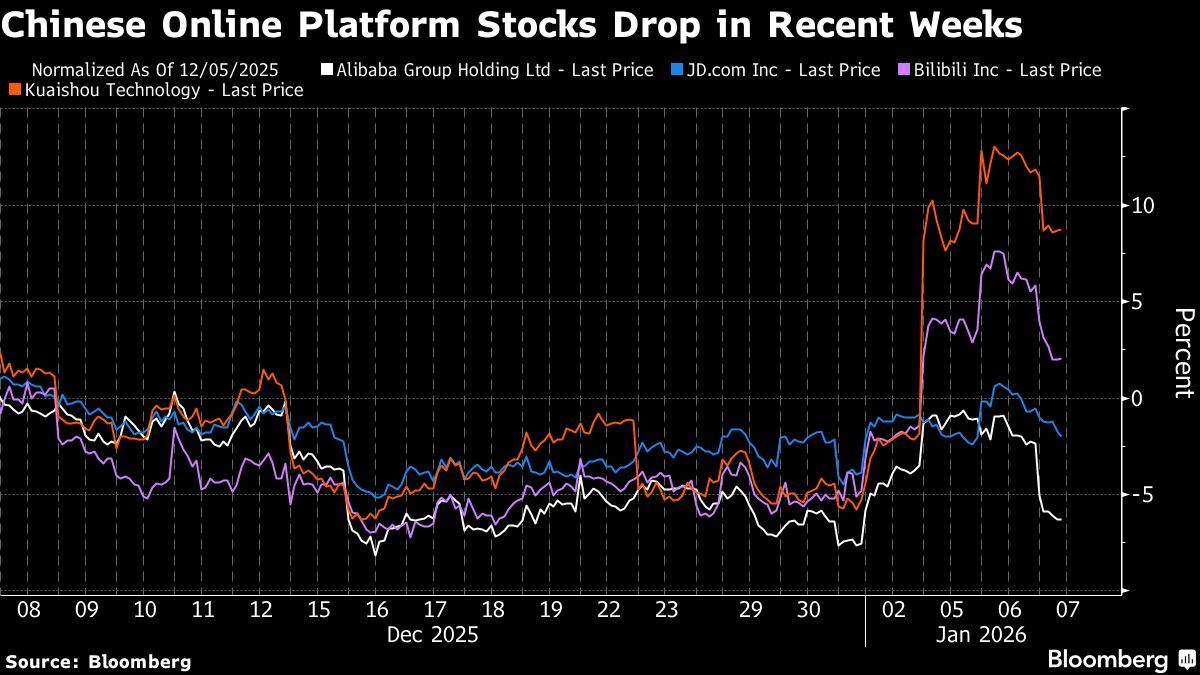

BEIJING – In a sweeping move to recalibrate its massive digital economy, Chinese regulators have unveiled a comprehensive set of new rules aimed at curbing aggressive subsidy wars and standardising the rapidly evolving livestreaming sector. The announcement, made on Wednesday, January 7, 2026, sent ripples through financial markets, wiping billions off the valuation of China’s e-commerce giants.

The New Regulatory Framework

The State Administration for Market Regulation and the Cyberspace Administration of China recently issued two landmark documents that represent the most significant industry intervention since 2021. These rules aim to dismantle the predatory subsidy wars that have drained industry margins for years. Large platforms can no longer force merchants into deep discount promotions or extreme price wars. This move specifically targets the aggressive competition where titans like Alibaba and Meituan poured billions into incentives to dominate meal delivery and grocery retail at the expense of market stability.

The digital frontier is also receiving a transparency makeover through the first formal regulation of AI in commerce. Digital avatars and AI hosts are now a staple for around-the-clock sales, and they must be clearly labelled. Platforms have to provide constant reminders to shoppers that they are interacting with an artificial entity to ensure that automation never leads to deception.

To protect the integrity of the marketplace, the guidelines establish strict guidelines against deceptive behaviour. The rules criminalise click farming and the fabrication of fake transactions, as well as the manipulation of engagement metrics. Most importantly, the regulations ban big data price discrimination where platforms use personal spending history to charge different prices for the same product.

To ensure these mandates work, the burden of enforcement now falls on the platforms themselves. Companies are legally required to build a credit grading system for influencers and livestream operators. Those who have poor records or engage in unethical marketing will face quick business restrictions or even permanent bans. This shift effectively ends the era of lawless digital promotion and signals a new age of accountability in the Chinese internet economy.

Market Reaction: Tech Stocks Retreat

Alibaba’s shares slid as much as 4.2% in Hong Kong, leading losses in peers such as AI video platform Kuaishou, JD and Meituan.

AI and the Future of Content

The inclusion of AI hosts is particularly noteworthy. According to a report from the SAMR Development Research Centre, AI technology is now used in more than half of all merchant-led livestreaming sessions in China. While the government recognized the efficiency gains AI provides, the new labeling requirements are intended to prevent the "misuse of technology" to deceive consumers with life-like virtual influencers.

Outlook for 2026

As the February implementation date approaches, major platforms are expected to begin large-scale internal audits to comply with the new "credit grading" and "real-name registration" requirements.

Author

I hold a deep passion for tracking and analyzing the latest corporate performance and broader financial news. I enjoy understanding how these developments shape market trends and investment strategy.

Sign up for The Fineprint newsletters.

Stay up to date with curated collection of our top stories.